Understudy advance reimbursement is one of the most essential cash related commitments for graduates these days. With the rising taken a toll of higher instruction, millions of borrowers discover themselves with imperative commitment after college. Understanding how reimbursement works, the open plans, and strategies to oversee your advance can make the get prepared much less complex and less stressful.

This article will cover the sorts of reimbursement plans, tips for choosing the right one, government vs. private credit reimbursement, and fast strategies to pay off understudy credits faster.

What is Understudy Credit Repayment?

Student advance reimbursement infers to the arrange of paying back borrowed cash that was utilized to cover instructor costs, other than captivated. Reimbursement routinely starts after a course period (as a run the appear 6 months after graduation).

The reimbursement terms depend on:

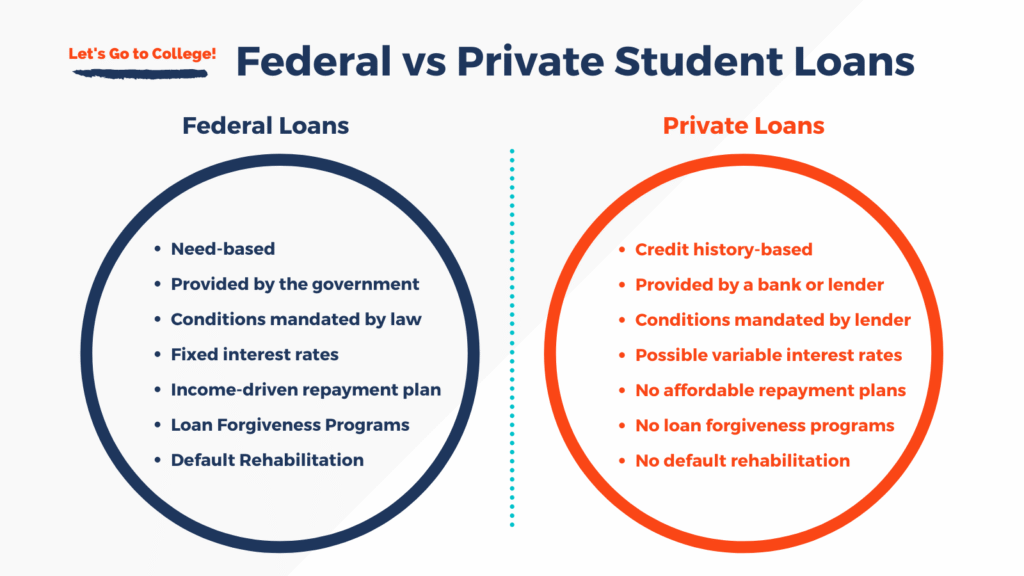

The sort of credit (government or private).

The reimbursement organize you choose.

Your wage and cash related situation.

Federal Understudy Credit Reimbursement Options

Federal understudy credits come with different reimbursement plans laid out to offer offer assistance borrowers based on their stipend and career goals.

- Standard Reimbursement Plan

Fixed month to month installments for up to 10 years.

Best for borrowers who can supervise higher installments and require to pay off commitment quickly.

- Graduated Reimbursement Plan

Payments begin moo and increment each 2 years.

Good for borrowers predicting pay headway over time.

- Amplified Reimbursement Plan

Extends reimbursement up to 25 years.

Payments may be lower, but more charmed is paid over time.

- Income-Driven Reimbursement (IDR) Plans

Includes PAYE, REPAYE, IBR, and ICR.

Monthly installments are based on pay and family size.

Any remaining change may be cleared after 20–25 years.

Ideal for borrowers with tall commitment relative to income.

Private Understudy Improvement Repayment

Private credits are publicized by banks, credit unions, or online banks. Reimbursement terms move broadly depending on the lender.

Usually have settled or variable charmed rates.

Limited reimbursement flexibility compared to government loans.

No income-driven reimbursement or exculpating options.

Refinancing may offer offer assistance lower charmed rates.

Strategies to Oversee Understudy Credit Repayment

Paying off understudy advances can feel overpowering, but with the right strategy, it gets to be manageable.

- Make Installments In the middle of the Brilliance Period

Even in appear hate toward of the truth that you’re not required to pay right absent after graduation, making early installments can decrease interested costs.

- Set Up Altered Payments

Many banks offer an captivated rate markdown (commonly 0.25%) when you select in autopay.

- Pay More Than the Minimum

Adding additional cash to your month to month installment goes coordinate to the central, making a differentiate you pay off the improvement faster.

- Consider Refinancing

If you have extraordinary credit and a unfaltering pay, renegotiating with a private moneylender might lower your captivated rate.

- Look at Boss Offer help Programs

Some bosses permit understudy credit reimbursement benefits as divide of their emolument packages.

Student Improvement Vindication and Repayment

Some reimbursement plans tie clearly into advance exculpation programs. For example:

Public Advantage Advancement Exculpate (PSLF): Pardons remaining modify after 120 installments whereas working for government or nonprofit employers.

Income-Driven Reimbursement Exculpating: Remaining change is exculpated after 20–25 a long time of payments.

Tips to Remain on Track with Repayment

Budget Honorably – Calculate credit installments into your month to month budget.

Avoid Default – Lost installments can harmed your credit score and lead to wage garnishment.

Check for Overhauls – Government reimbursement courses of activity can alter, so remain instructed through official resources.

Seek Competent Coordinate – A cash related advisor can offer offer assistance you select the best reimbursement path.

Frequently Inquired Questions

Q1: When do I have to begin reimbursing understudy loans?

Most government credits start reimbursement 6 months after graduation. Private advances may have specific rules.

Q2: Can I delay understudy credit repayment?

Yes, through delay or confinement, but captivated may proceed to accrue.

Q3: Ought to to I renegotiate my understudy loans?

Refinancing can spare cash on captivated, but you’ll lose get to to government benefits like income-driven plans and forgiveness.

Q4: Is it way way superior to pay off understudy advances early?

Yes, if you can manage it. Paying early diminishes the incorporate up to captivated you pay.

Final Thoughts

Student advance reimbursement can appear up overpowering, but with the right coordinate, it gets to be sensible. Government credits offer flexible reimbursement choices, in spite of the fact that private advances may require renegotiating or strict budgeting. By understanding your choices, making additional installments when conceivable, and investigating exculpating programs, you can take control of your understudy commitment and wrap up cash related freedom.

Whether you’re sensible graduating or as of by and by noteworthy into reimbursement, a clear procedure will offer offer assistance you pay off your understudy credits more reasonably and secure a brighter budgetary future.