Paying for higher instruction frequently requires budgetary back, and understudy credits are one of the most common ways understudies cover educational cost, lodging, and other costs. But one key figure that altogether influences the taken a toll of borrowing is the intrigued rate.

Understanding understudy credit intrigued rates—how they are set, how they influence reimbursement, and how to compare them—is basic some time recently taking on obligation. This direct will break down everything you require to know around government and private understudy advance intrigued rates in 2025.

What Are Understudy Credit Intrigued Rates?

An intrigued rate is the rate charged by a loan specialist on the cash borrowed. For understudy advances, this rate decides how much additional you’ll pay over the life of your credit in expansion to the unique sum (principal).

For example:

- If you borrow $10,000 at a 5% intrigued rate, you’ll pay $500 per year in intrigued until the adjust is reduced.

- This implies indeed a little distinction in intrigued rates can include up to thousands of dollars over time.

- Federal vs. Private Understudy Credit Intrigued Rates

- There are two primary sorts of understudy advances, and their intrigued rates work differently:

- Feature Federal Understudy Loans Private Understudy Loans

- Set By U.S. Division of Education Banks, credit unions, online lenders

- Rate Type Fixed (does not change) Fixed or variable (can alter over time)

- Based On Set every year by Congress Credit score, salary, co-signer

- Forgiveness Options Eligible for PSLF, IDR forgiveness No pardoning programs

- Repayment Flexibility Income-driven plans available Limited options

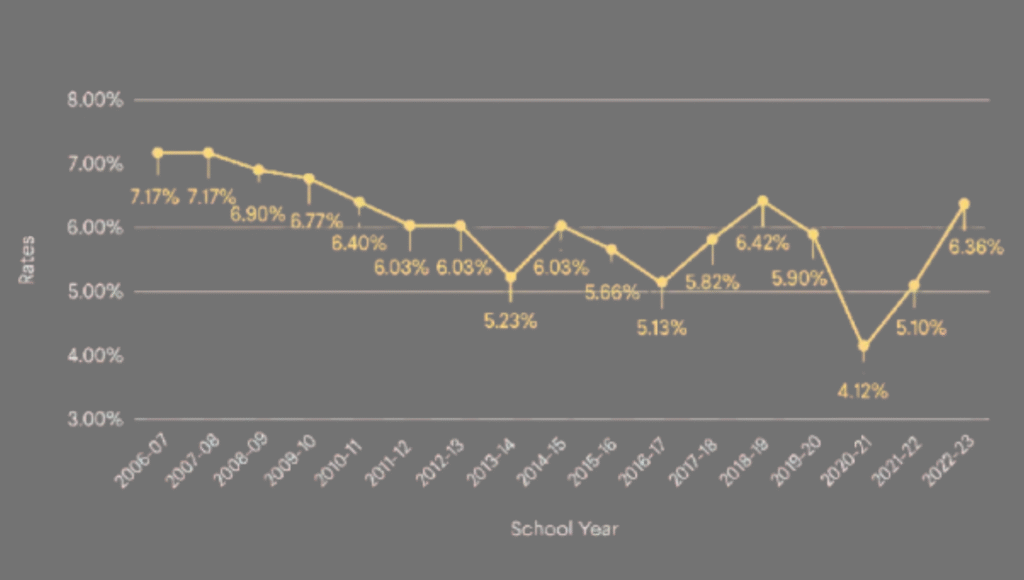

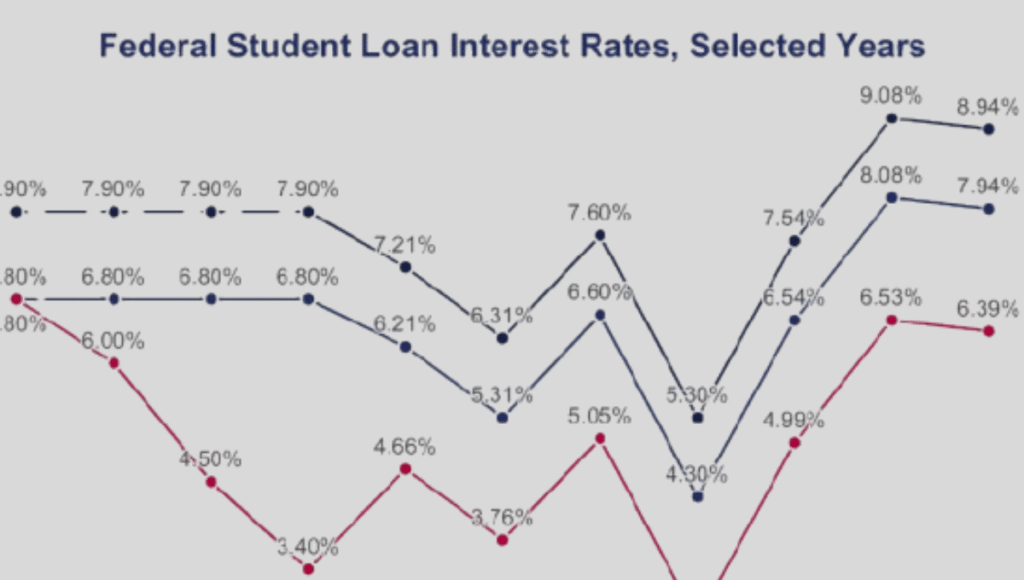

- Federal Understudy Advance Intrigued Rates in 2025

Federal understudy advances more often than not offer lower, settled rates and superior assurances compared to private advances. Rates are set every year each summer for the up and coming scholarly year.

For the 2025 scholastic year, inexact government understudy credit rates are:

Direct Subsidized Credits (Undergrad): 5% – 6%

Direct Unsubsidized Advances (Graduate): 6% – 7%

Direct Also Advances (Guardians & Graduate Understudies): 7% – 8%

These rates remain settled all through the life of the advance. That implies if you borrow presently, your intrigued rate will not increment later.

Private Understudy Advance Intrigued Rates

Private loan specialists decide rates based on credit history, wage, and co-signer quality. Not at all like government credits, these rates can be settled or variable:

Fixed Rates – Remain the same for the whole credit term.

Variable Rates – Begin lower but may rise over time depending on showcase conditions.

In 2025, normal private understudy advance rates run between:

Fixed: 4% – 12%

Variable: 3% – 10% (but may increment essentially over time)

Students with fabulous credit (or a co-signer with solid credit) may qualify for the most reduced rates, whereas those with weaker credit may confront higher rates.

How Intrigued Rates Influence Understudy Credit Repayment

Interest rates specifically affect:

Monthly Installments – Higher rates = higher month to month bills.

Total Credit Taken a toll – Over 10–20 a long time, indeed a 1% contrast can include thousands of dollars.

Repayment Methodology – Borrowers with tall rates may advantage from renegotiating or quickened repayment.

Example:

Borrowing $30,000 at 5% over 10 a long time costs approximately $38,180 total.

Borrowing the same sum at 8% costs almost $45,600 total.

That’s more than a $7,000 distinction fair from the intrigued rate.

Tips to Get the Least Understudy Advance Intrigued Rates

Maximize Government Credits To begin with – They as a rule have the most reduced settled rates.

Improve Your Credit Score – Pay bills on time and decrease obligation some time recently applying for private loans.

Use a Co-signer – A financially sound co-signer can lower private credit rates.

Compare Numerous Moneylenders – Rates change broadly; don’t acknowledge the to begin with offer.

Choose Settled Rates – Secures you from rising costs if intrigued rates increment in the future.

Consider Renegotiating Afterward – Once you graduate and your credit moves forward, renegotiating may decrease your rate.

Should You Stress Almost Rising Intrigued Rates?

Yes—especially with private credits. Government rates are settled, but private variable credits may increment essentially if advertise intrigued rates rise. Borrowers taking variable-rate credits ought to budget for conceivable increases.

If you’re stressed approximately future installments, choosing a fixed-rate advance offers more stability.

Final Thoughts

Student advance intrigued rates are one of the most critical components to consider some time recently borrowing. Government advances regularly give the most secure and most reasonable choices, whereas private credits can offer assistance cover financing crevices if you qualify for moo rates.

To keep your instruction affordable:

Borrow as it were what you need.

Prioritize government loans.

Compare private moneylenders carefully.

Understand how intrigued will influence your reimbursement over time.

With savvy arranging and mindfulness of intrigued rates, you can diminish the long-term taken a toll of your understudy obligation and oversee reimbursement more successfully.