What is a Credit Score?

A credit score is a three-digit number that reflects how financially trustworthy you are when it comes to borrowing money. This number typically ranges from 300 to 850, with higher scores representing better creditworthiness. Your score is determined by your credit history — including how consistently you pay your bills, how much debt you carry, and what types of credit accounts you maintain.

Your credit score works like a financial report card, showing lenders how responsible you are with money and debt management. When you apply for a loan, credit card, car lease, or mortgage, banks and financial institutions look at your score to decide whether they should approve your application and what interest rate to offer. A higher credit score generally means lower interest rates and better financial opportunities.

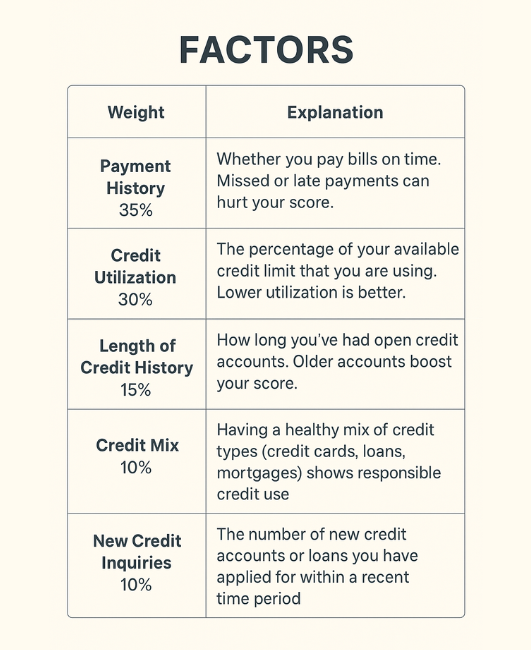

How Credit Scores Are Calculated

Credit scores are calculated using scoring models such as FICO and VantageScore, which analyze your credit report data. Here’s how most scoring models break it down:

Why Your Credit Score Matters

Your credit score isn’t just a number — it directly affects your financial life. A good credit score can:

- Get You Approved for Loans & Credit Cards – with lower interest rates and higher credit limits.

- Help You Qualify for a Mortgage or Car Loan – making it easier to buy a house or car.

- Save You Money – many insurers use credit scores to determine premiums, so a higher score can lower insurance costs.

- Make Renting Easier – landlords often check credit reports before approving rental applications.

- Avoid Large Deposits – for utilities, cell phone plans, and even some services, good credit means lower upfront costs.

How to Improve Your Credit Score Fast

If your credit score isn’t where you want it to be, don’t worry — there are proven steps you can take to raise it quickly:

Pay Your Bills On Time

Your payment history makes up 35% of your credit score, so it’s the single most important factor. Set up automatic payments or reminders to make sure you never miss a due date. Even one late payment can hurt your score significantly.

Lower Your Credit Utilization

Credit utilization is the second most important factor. Aim to keep it under 30% of your total credit limit. For example, if your combined credit card limit is $10,000, try to keep your balance under $3,000. Paying off existing balances or making extra payments during the month can lower your utilization fast.

Request a Credit Limit Increase

If you have a good history with your credit card issuer, ask for a higher limit. This will improve your utilization ratio instantly — as long as you don’t increase your spending.

Avoid Too Many Hard Inquiries

Whenever you submit an application for a new credit card or loan, a “hard inquiry” is recorded on your credit report, which may temporarily lower your score.Too many inquiries in a short period can lower your score temporarily. Apply only when necessary.

Become an Authorized User

If you have a family member or trusted friend with a long history of on-time payments, ask them to add you as an authorized user on their credit card. Their positive history can be added to your report, giving your score a boost.

Dispute Credit Report Errors

According to studies, around 20% of credit reports have errors. Get a free copy of your report from AnnualCreditReport.com, check for mistakes like incorrect late payments or accounts that don’t belong to you, and dispute them with the credit bureau. Removing false negatives can improve your score quickly.

Long-Term Strategies for Healthy Credit

While quick fixes are helpful, building a strong credit profile for the future is equally important:

- Keep Old Accounts Open: Closing your oldest credit card reduces your average credit age and can lower your score.

- Maintain a Healthy Credit Mix: Having a variety of accounts (credit cards, personal loans, auto loans) shows you can manage different types of credit responsibly.

- Monitor Your Credit Regularly: Use free services like Credit Karma, Experian, or NerdWallet to track your progress and get alerts about suspicious activity.

FAQs About Credit Scores

Q1: How quickly can a credit score be improved? A: Small improvements can show up within 1–2 months if you make consistent on-time payments and reduce debt. For significant results, it may take 6–12 months of good credit habits.

Q2: Is it possible to build or improve a credit score without using a credit card? A: Yes! You can improve your score by paying all bills (rent, utilities, phone) on time and using services like Experian Boost to get those payments added to your credit history.

Q3: Will checking my credit score lower it A:No. Checking your own score is a soft inquiry, which does not affect your credit rating.

Q4: What is a good credit score? A:Typically, 670–739 is considered good, 740–799 very good, and 800+ excellent. The higher your score, the better your financial opportunities.

Your credit score is more than just a number — it’s a key that opens the door to financial opportunities. By understanding how scores are calculated and following best practices like paying on time, keeping debt low, and monitoring your credit, you can see significant improvements — sometimes in just a few months. Consistency is the key to not just raising your score quickly but keeping it high for the long run.