Paying for college can be challenging, and whereas government understudy credits are regularly the to begin with alternative, they may not continuously cover the full fetched of educational cost, lodging, books, and other costs. That’s where private understudy advances come in. These advances are advertised by private lenders—such as banks, credit unions, and online monetary institutions—to offer assistance bridge the crevice between government help and the add up to fetched of attendance.

In this article, we’ll investigate what private understudy advances are, how they work, their benefits, dangers, and tips for making the right borrowing decision.

What Are Private Understudy Loans?

Private understudy credits are credits taken from non-government loan specialists to cover instruction costs. Not at all like government understudy advances, which are financed and supported by the U.S. Division of Instruction, private credits are given by monetary teach and come with shifting intrigued rates, terms, and qualification requirements.

Key things to know:

Interest rates can be settled or variable.

Approval is more often than not based on your credit score and income.

Many understudies require a co-signer (regularly a parent or gatekeeper) to qualify.

Loan terms, reimbursement alternatives, and benefits vary by lender.

Differences Between Government and Private Understudy Loans

Understanding how private advances vary from government ones is essential:

Feature Federal Understudy Loans Private Understudy Loans

Provider U.S. Office of Education Banks, credit unions, online lenders

Credit Check Not required (but Also loans) Required

Interest Rates Fixed, set by Congress Fixed or variable, based on credit

Repayment Plans Income-driven choices available Limited reimbursement flexibility

Loan Forgiveness PSLF and IDR absolution possible No pardoning programs

Co-signer Needed? No Often yes

Benefits of Private Understudy Loans

Even in spite of the fact that government advances are ordinarily the way better to begin with choice, private understudy credits can be supportive in certain situations:

Covers the Subsidizing Gap

When government advances, grants, and awards aren’t sufficient, private credits offer assistance pay for remaining costs.

Potentially Lower Intrigued Rates

Students (or co-signers) with great credit may qualify for rates lower than government Also loans.

Flexible Credit Amounts

Many loan specialists permit you to borrow up to the full fetched of attendance.

Fast Application Process

Private advances regularly have speedier endorsement and subsidizing compared to government loans.

Drawbacks of Private Understudy Loans

Before borrowing, consider the risks:

Limited Reimbursement Alternatives – Not at all like government credits, private banks once in a while offer income-driven repayment.

No Advance Absolution – You cannot get to government absolution programs like PSLF.

Variable Intrigued Rates – A few credits have rates that can increment over time.

Credit Reliance – Understudies with destitute or no credit may battle to qualify or confront tall intrigued rates.

Co-signer Chance – If you can’t make installments, your co-signer gets to be responsible.

Who Ought to Consider Private Understudy Loans?

Private credits may be right for you if:

You’ve as of now maxed out government understudy aid.

You or your co-signer have solid credit and can secure a moo intrigued rate.

You require additional reserves for educational cost, lodging, or consider overseas programs.

You get it the dangers and are certain in your capacity to repay.

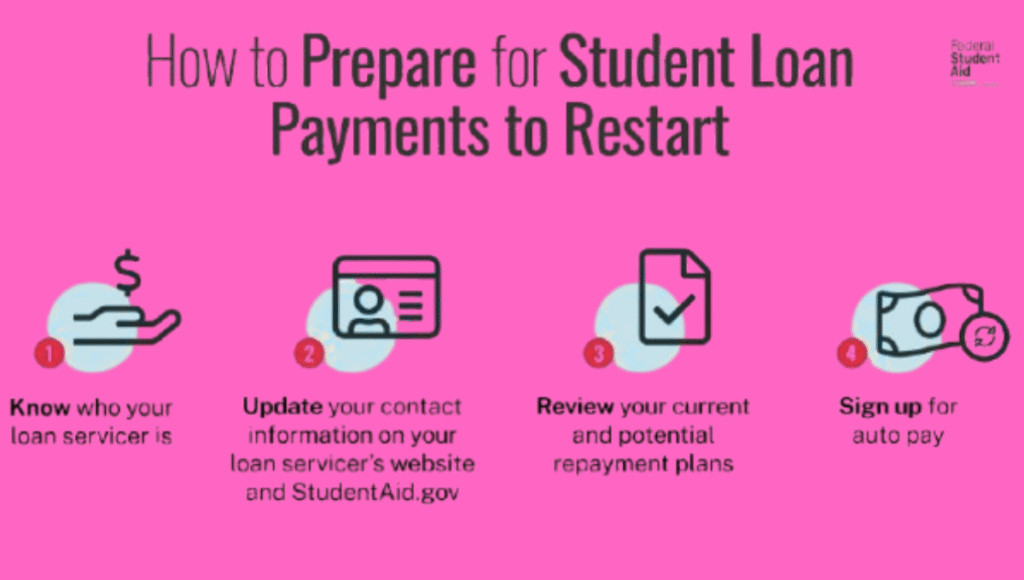

How to Apply for a Private Understudy Loan

Applying for a private understudy advance ordinarily includes these steps:

Research Moneylenders – Compare banks, credit unions, and online platforms.

Check Your Credit Score – Higher scores regularly cruel superior rates.

Find a Co-signer (in case required) – Numerous understudies depend on guardians to co-sign.

Complete the Application – Give monetary and school information.

Review Terms Carefully – Get it intrigued rates, reimbursement choices, and fees.

Accept and Get Stores – Once endorsed, stores are dispensed to your school.

Tips for Borrowing Private Understudy Credits Wisely

Borrow as it were what you require – Don’t take out more than the taken a toll of your education.

Compare different moneylenders – Rates and benefits shift widely.

Choose settled rates if conceivable – This secures you from future rate hikes.

Ask around reimbursement alternatives – A few banks permit interest-only installments whereas in school.

Plan reimbursement early – Consider future career salary and month to month budget.

Alternatives to Private Understudy Loans

Before turning to private advances, investigate other financing options:

Scholarships and Awards – Free cash you don’t have to repay.

Work-Study Programs – Win cash whereas studying.

Federal Credits – Frequently have lower, settled rates and adaptable repayment.

Part-Time Work or Side Hustles – Diminish dependence on loans.

Final Thoughts

Private understudy advances can be a important instrument when government help, gifts, and grants aren’t sufficient. They give additional subsidizing, particularly for understudies with solid credit or a solid co-signer. In any case, they too come with risks—like higher intrigued costs, less reimbursement alternatives, and no absolution programs.

Before borrowing, maximize your government help, apply for grants, and calculate how much you really require. If you choose a private credit is the right choice, compare banks carefully and borrow dependably to ensure your money related future.